Most Experts Agree: ‘We are not in a new Housing Bubble’. There is no doubt that the home prices in Orange County as well as the vast majority of markets across the country have increased.

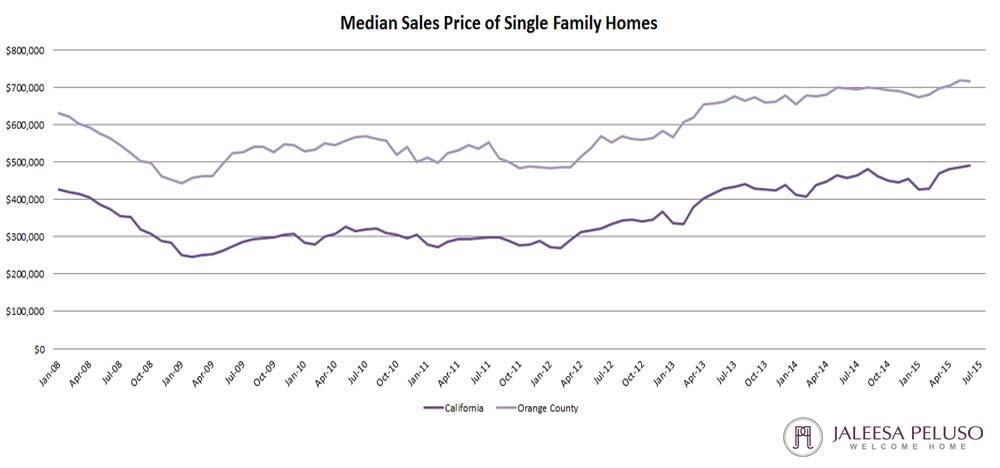

The top image shows the appreciation levels of single family homes in Orange County and California (source). These recent increases in value have caused some to be concerned about a new price bubble forming.

What Industry Experts Are Saying:

Nick Timiraos, reporter at the Wall Street Journal:

“Predictions of a new national home price bubble look unfounded for now, according to data.”

Michael Fratantoni, Chief Economist, the Mortgage Bankers Association:

“I don’t really see it as a bubble.”

Jack M. Guttentag, Professor of Finance Emeritus at the Wharton School of the University of Pennsylvania:

“My view is that we are a long way from another house price bubble.”

Rajeev Dhawan, Director of Economic Forecasting Center at J. Mack Robinson College of Business, Georgia State University:

“To have a bubble, you need to have construction rates higher than the perceived demand, which is what happened in 2003 to 2007. Right now, however, we have the reverse of that.”

Victor Calanog, Chief Economist, Reis:

“The housing market has yet to show evidence of systematic runaway asset price inflation characterized by home prices rising much faster than household income.”

David M. Blitzer, Chairman of the Index Committee for S&P Dow Jones:

“I would describe this as a rebound in home prices, not a bubble and not a reason to be fearful.”

Andrew Nelson, US Chief Economist, Colliers International:

“I don’t think there is a housing bubble.”

George Raitu, Director, Quantitative & Commercial Research, NAR:

“We do not consider the current market conditions to present a bubble.”

Christopher Thornberg, Founding Partner, Beacon Economics:

“The housing market is far from overheated.”

(source):

So, why do prices feel so high?

Today, there is a gap between supply (number of houses on the market) and demand (the number of buyers looking for a new home). In any market, this would cause values to increase. Here are some experts’ comments on this issue:

Jonathan Smoke, realtor.com Chief Economist:

“So does that mean we’re in a bubble? Nope, that’s just what happens when demand increases faster than supply.”

Robert Bach, Director of Research – Americas, Newmark Grubb Knight Frank:

“I don’t think the housing market is overheated based on demand and supply fundamentals.”

Mark Dotzour, Chief Economist, Real Estate Center, Texas A&M University:

“We are not in a housing bubble. We are in a situation where demand for houses is much higher than supply.”

Calvin Schnure, SVP of Research & Economic Analysis, NAREIT:

“Given all the demand and little supply the residential market is FAR from overheated.”

Bottom Line

Currently, there is an imbalance between supply and demand for housing. This has created a natural increase in values, not a bubble in prices.

Have you been thinking of selling? This could definitely be a great time! Call or Text (949)395-0960 for a free home evaluation!

About Jaleesa Peluso, Coastal Orange County Realtor

Jaleesa Peluso is an Orange County real estate agent based out of the Berkshire Hathaway Laguna Beach real estate office. Thinking of buying, selling or renting your South Orange County house? Call us now at (949)395-0960!