Are you looking to buy a home in the United States from abroad? Are you thinking of moving here from Europe or elsewhere in the world? Look no further! This is your Buyer’s Guide to California Real Estate!

In this blog post I will get into 3 of the main things you will have to consider. I will give you concrete steps towards how to buy property in the US;

Now this post is geared especially towards Europeans who are looking to buy in California. If you are from a different region or looking for a different state, this post will still have tons of useful information for you. If this is the case for you, just reach out to me. My contact info is below and in the description of this video. I can put you in touch with all the right people.

Ok, lets get to it!

Is your first question…

Can I buy a home in the US if I am neither a citizen of the USA, nor a legal resident?

YES! Europeans can buy property in the US with relatively few barriers. There are simply a few different considerations we have to make as compared to when citizens or residents buy homes. But this is nothing that we can’t figure out.

There are a few important items that you will need to consider. These items are: Financing the transaction, using a real estate agent, the actual purchasing process and finally tax implications.

1. How do you plan to finance property?

Purchasing California property all-cash is without a doubt the easiest way to buy. Perhaps the biggest challenge for foreigners is getting a loan or mortgage. Now I should point out that if you are a permanent resident or have a work visa, it will generally be easier for you to qualify for a US home loan.

When a US resident buys property with a mortgage, the financial institution will do a risk analysis on the buyer. The lender looks at your employment, credit history, income history, savings, etc.

It is harder for Europeans to provide the information required, and this is especially true for the US Credit Report. You will likely not have a qualifying credit report, so the banks have to do a different type of risk analysis for the loan approval. Some lenders may be willing to order international credit reports as a substitute for the three major U.S. credit bureaus but this is not that common yet. If you have plenty of time before your purchase, a good strategy is to establish a relationship with a U.S. bank in order to build up an American credit report history.

Keep in mind as well that foreign buyers of California homes may pay a higher interest rate, and may be required to come up with a higher down-payment amount (often anywhere between 20% and 50%).

So in summary, there are absolutely financial institutions who can and want to help you with your loan. It may just take a bit more time and effort. If you have any questions about this, just reach out and I can help as well as refer you to a lender.

2. Using a real estate agent

In the US it is common for buyers and sellers to have their own real estate agent. In California it is common practice for the seller to pay the buyer’s real estate agent fee. That means that in many cases, you as a buyer, will not pay directly for your own agent’s services. The cost is effectively built into the price. There may be some exceptions such as off market listings, and you can discuss these with your agent before you get started together.

In the US, estate agents cooperate and one agent can show property listed by different brokers through the use of the so called MLS or multiple listing service. This is a different system from what we see in countries such as the Netherlands or the UK where it might be more beneficial to work with several different agents in order to see all the home listings.

Most domestic and foreign buyers will usually find one agent that they like and trust and then choose to work with that one person throughout the entire home buying process. It often makes the process easier, and as I mentioned before, the commission for the buyer’s agent usually comes directly out of the sellers proceeds.

Your agent will then become your first point of contact, help you find different properties, even those listed with different agents. They will organize and accompany you on home tours, write up your offer, manage the transaction and support you all the way through close of escrow and the key exchange. It is therefore suggested you pick and work with one agent so that this person will also commit to working with you and be willing to go the extra mile for you.

Your agent should be an expert in your target area so that they can help you identify the pros and cons of different neighborhoods, help find the best school districts, locate off-market properties and have a solid understanding of pricing and rental rates in a particular area.

This also brings up another question I get asked frequently. Do you need to hire an attorney? Most local buyers do not use attorneys in their real estate transactions. The estate agent is the one who writes the contract. However, you have the right to consult or hire an attorney to review documents, etc. as you see fit.

Now, global transactions are significantly different and more complex than domestic deals. Working with a real estate agent who knows how to handle these differences can make or break a real estate transaction. Because of these nuances, it is essential to work with a trusted professional such as Certified International Property Specialist or CIPS. CIPS estate agents have undergone specialized training to complete global transactions.

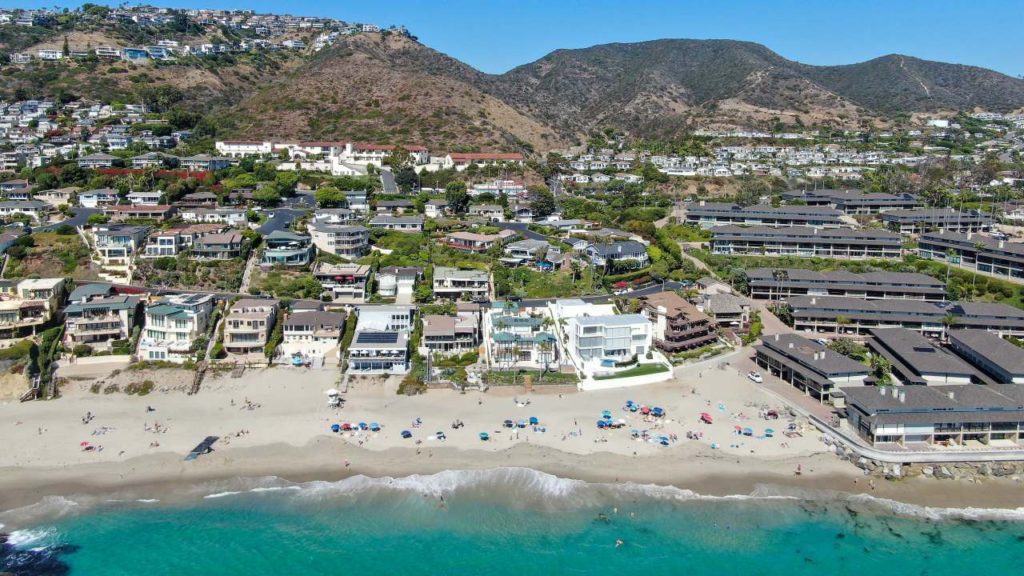

I myself am a European and a CIPS agent, so I have a unique experience and understanding when it comes to buying US real estate and/or even moving here from across the Atlantic! I specialize in the Orange County area of California. If you are watching this video and are looking in a different region, whether LA, San Diego, San Francisco or even a different state. Please don’t hesitate to reach out. I will happily put you in touch with a qualified agent who can help you in any market across America.

3: The Transaction Process

I plan to do another video explaining the transaction process in more detail. But here is what the general process looks like.

First you will want to select an agent so that they can help you get your financing in order by helping you get in touch with a lender so you can get pre-approved for a loan. Based on that pre-approval you can start looking for homes with your agent, which is number 2.

You will then make an offer together on the home that you like and negotiate the sales price, deposit and other terms of the agreement. If you have an accepted offer you will enter what is called escrow. This is usually a roughly 30-40 day period in which the transaction is being worked through with the help of both the buyer’s and seller’s agent, the lender and an independent escrow officer.

During this stage you will have the right to collect information about the property, do your investigations, inspections, etc. With your contingencies in place you can still back out and cancel the purchase if you change your mind. After this period you will have to put in writing whether or not you plan to proceed with the purchase. If you change your mind after this so called ”contingency-removal” your risk losing your deposit. Finally, you will transfer the remaining balance of the purchase, sign the final documents and the new title to the house will be recorded in your name.

Keep in mind that most of the documents are signed digitally nowadays. However, some documents will need to be signed in the presence of a notary public and you may need to be present in the US, go to a local embassy or use a power of attorney in order to sign these documents.

4: Taxes to consider when a European buys a home in Orange County, California

Taxes can be complicated by nature and depending on your situation. If you are buying US real estate, the US gov tries to keep it simple.

Right off the bat, I will tell you that it is my opinion you should consult with a local Certified Public Accountant who can fill you in on exactly what type of tax consequences a purchase of orange county real estate will have if you are a foreign investor. Tax laws can be complex, are ever changing and can vary significantly based on your personal situation. Here are several instances in which you may be required to pay taxes:

If you, as a European real estate investor decide to sell the property, you will be subject to capital gains tax. The amount of tax will depend on your foreign investor’s tax status in the United States. You may also be subject to taxation in your home country on any income from their US property. In some cases, this can lead to double taxation.

You will be required to disclose your ownership of US real estate on your annual tax return. If you rent out the property, you may also have to pay taxes on any rental income received from the property. The tax rate will depend on your tax status in the United States.

There are some withholding requirements for foreigners buying real estate in California. You may be required to withhold taxes during the purchasing process. You may also need to withhold taxes from your tenants in certain cases.

Another consideration is that you should be aware of estate taxes. If you were to pass away, your California real estate may be subject to estate tax.

So these are the 4 most important things to consider when buying a home in the US as a European. I have given you concrete steps to take towards buying property. As I mentioned, the first step is to align yourself with a real estate agent! Whether you are looking in California, or elsewhere, please feel free to reach out to me and I would love the opportunity to help you or refer you to a qualified colleague in a different region.

This is Jaleesa Peluso, real estate agent with Berkshire Hathaway. Please call/text/whats-app me anytime at +1 (949) 395-0960