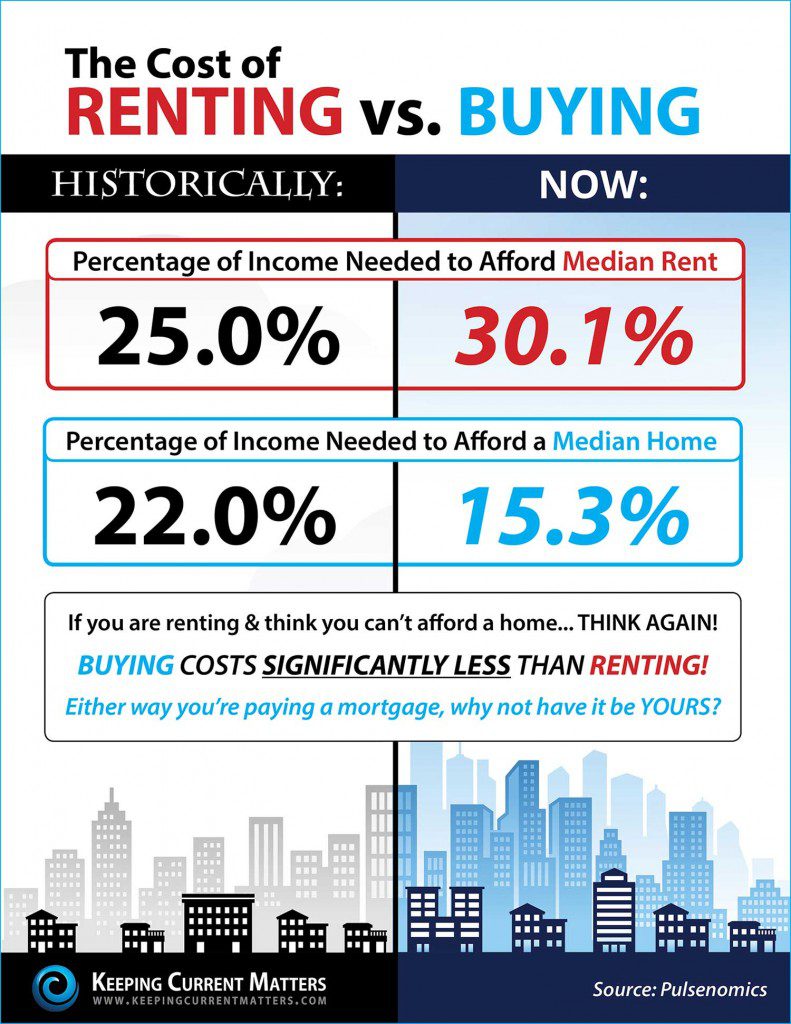

Do you know the cost of Renting vs. Buying? Historically the % of your income needed to afford a home vs renting was a much closer margin. Renting made a lot more sense. Now… Renting will cost you 30.1% of your income compared to buying a median home at 15.3% of your income. Either way you’re paying a mortgage… why not have it be yours?

As a homeowner you are also able to deduct mortgage interest and property taxes from your income. Moreover, you will be building your equity and wealth every month. In the Survey of Consumer Finances conducted by the Fed, it was found that the average net worth of a homeowner ($194,500) is 36x greater than that of a renter ($5,400)!

Renting, in contrast to buying, offers the potential for comparable wealth building only if renters invest an amount equal to a down payment plus any savings from renting. As a means to building wealth, there is no practical substitute for homeownership [source: New York Times].

If you are a renter who is considering making a purchase, give us a call at (949)395-0960. Me and my team can help explain the benefits of signing a contract to purchase over renewing your lease!

About Jaleesa Peluso Orange County Real Estate

Jaleesa Peluso and her team are based out of Berkshire Hathaway California Properties in Laguna Beach. Representing first time homebuyers in Orange County is one of our specialties. Thinking of buying? Give us a call at (949)395-0960.