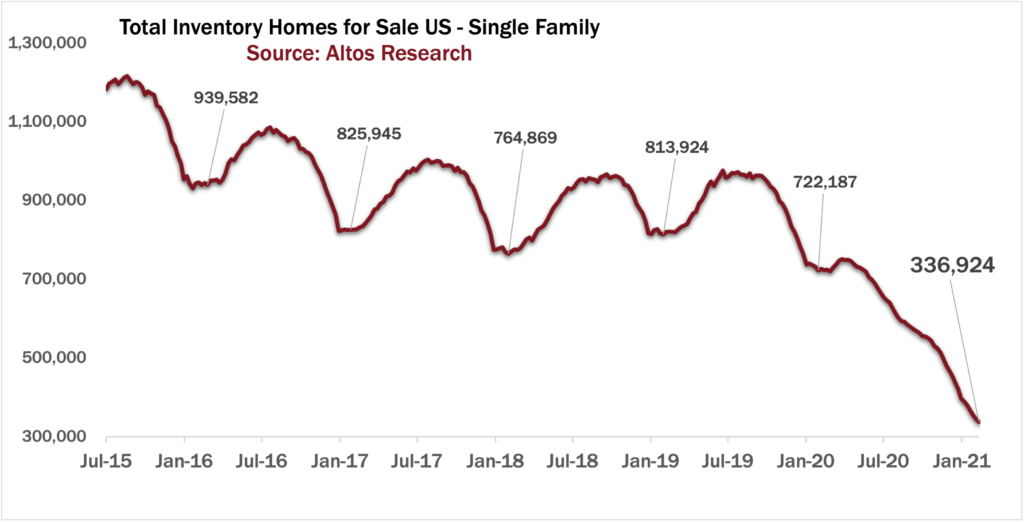

This situation isn’t just pandemic related. The inventory crisis has been years in the making, driven by a variety of market trends that may not change soon.

In March of last year, we had just been thrown into our first “lockdown”. I listed a property at that time and remember being pretty worried for my sellers about the state of the market. Agents were predicting serious downfalls in home pricing, of as much as 30%. Luckily, I sold the home within 14 days, with multiple offers at full price. That should have been the first indication that the 2020 real estate market was not going to be anything like what we might expect during a pandemic.

Many industry professionals expected a looming crisis. As it turns out, we were wrong. Demand for homes skyrocketed, and prices shot up as much as 10% year over year in some markets. We are still in a crisis, just not the crisis we expected. We are in an inventory crisis.

What happened?

1. Low-interest rates

Low interest rates are the driver of both increased demand and decreased supply. When rates are this low, it becomes very inexpensive to keep property for investment income rather than selling. Combine this with big institutional investments in single family homes, is the reason that over 7 million previously resalable properties are now in the rental market [source; Inman].

2. Not enough construction

Homebuilders built about half as many homes as they used to for most of the past decade and are only now reaching long-term normal construction levels. Without new construction, sellers are more hesitant to list their homes because there’s nothing to buy. It is a catch 22.

3. Rents are high

During the past decade, income generated by properties has consistently improved. In addition to long term rental income, websites like VRBO and AirBnB have made it easier than ever for home owners to get maximum rental income on their properties.

4. Millennials

Yes really… There are more millennials than any other generation, and millennials are looking to buy homes for their families now and for at least 5 to 10 more years.

5. Homeowner-focused policy

From Inman: The CARES Act foreclosure moratorium has kept some properties from coming to market, staying instead in the hands of distressed owners. But the foreclosure pipeline was already at record lows before the pandemic hit, and Americans have gained a trillion dollars of home equity since then.

As a result, pandemic-distressed homeowners seem unlikely to add to our inventory any time soon. Although there are still 2.5 million homeowners in the mortgage forbearance program, many of whom have not made a mortgage payment in a year, these homeowners have gained significant equity wealth in that time.

People default on a loan when the deal is not worth saving, or they’re upside down on the value. Very few people are facing that situation this time around.

The fact is that policymakers have been focused on keeping people in their homes. Essentially all U.S. housing policy, whether tax, mortgage markets or pandemic-related, is aimed at helping people who already own their home, often to the detriment of new buyers. [Source: Inman]

Is there a way out?

Well… As of right now, it sounds like we are going to be in this market for a little longer. Buyers are finding that they need to be both patient and ready to jump on an opportunity when it comes along.

As rates will start increasing over time, consumers will start feeling the higher payments in their pockets. This will slow the boiling hot demand for buying homes with cheap money. This will change the calculus of what they buy and also what they hold onto or sell to finance the new move.

New-home construction is also finally climbing and will begin to add a little to the market. More construction will be critical for boomers to move into retirement and millennials to get their first homes.

About Jaleesa Peluso, Laguna Beach Realtor & Certified International Property Specialist.

Best of OC Real Estate Agent 2020 by the LA TIMES!

Jaleesa and her team specialize in representing local as well as foreign buyers and sellers of Orange County real estate. Are you considering leasing, buying or selling your Orange County home? Call us now at (949)395-0960!